Copyright © Gecko Software, Inc., All Rights Reserved | Contact Us | Privacy Policy | Risk Disclosure

TradeMiner Review

Gecko Software, Inc.

271 N. Spring Creek Pkwy. Ste. A

Providence, UT. 84332 USA

Phone:800-862-7193

Email:gecko@geckosoftware.com

Website:www.TradeMinerPro.com

Product:TradeMiner Pro, Software for finding seasonal

cycles, trends, and patterns in Stocks, Futures, & Forex.

Requirements: Windows, Mac OS, or Linux

200 MB free hard disk space, 1024x768 screen

resolution (minimum) Larger recommended.

RAM 2GB (more is better). Requires Internet

connectivity for installation, but not to run the

application itself, CPU: 2.4 GHz or higher.

-------------------------------------------------------------

by Kent Kofoed

-------------------------------------------------------------

The TradeMiner Pro software is available for Stocks &

Futures markets. The main premise of TradeMiner Pro

is that markets tend to move in cycles and trends.

Because these markets trends tend to repeat

themselves over time, knowing how to recognize these

trends will help any trader make more informed trading

decisions. Even though this review focuses solely on

TradeMiner Pro for stocks, TradeMiner Pro Futures

platform is very similar, so many of the features

mentioned here are included in those packages as well.

What does TradeMiner Pro do exactly?

TradeMiner Pro allows traders to dig through years of

historical stock price data, of all of the stocks that are

listed in the S&P 500, the Dow 30, the Nasdaq 100, as

well as hundreds more stocks & ETF’s. The software

will sort though this data to help tell you what to trade

and when to trade it, with the characteristics of the

trade being specified by you. By allowing you to easily

analyze the historical price data of these actively traded

stocks you will be able to quickly uncover cycles and

trends that meet your search criteria. The design of the

software makes it easy to get

started and, after a short time,

the easy-to-use format allows

you to navigate the software

quickly and easily. Even though

the software does have a pretty

basic design, making it easy for

anyone to use, it has everything

that is needed to quickly sort

through large amounts of data and uncover investment

opportunities.

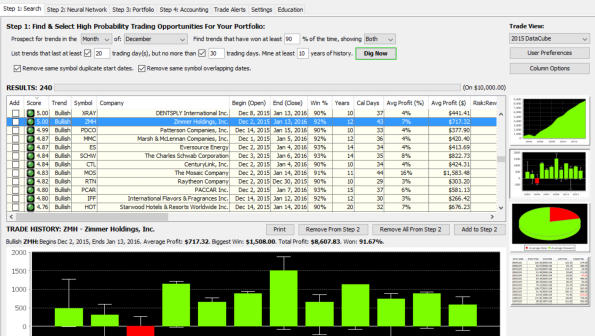

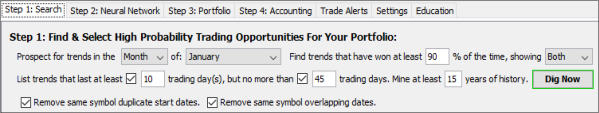

In addition to being very intuitive, the software is also

very user friendly. The data that you input is in

paragraph format, making it easy to key in your desired

search criteria. For example, a typical search would look

something like this (with the data in bold being the

criteria)… "Prospect for trades in the Month of:

December. Find trades that win at least 90% of the

time, showing Buy. List trades that last at least 10

trading day(s), but no more than 30 trading days. Mine

at least 20 years of history. Dig Now!" You can "dig"

through the data according to which month you are

looking to find opportunities, what length of trading

period those opportunities should be, and what type of

order you are looking, as well as the probability of that

trade being a winning trade. In addition to looking for

any stock within a certain month, you can also mine a

specific stock to find out when the best time to trade

that stock is, historically.

There are three basic steps to the mining process that

can be found in the "Search" tab, “Neural Network” tab,

and "Portfolio" tab. The "Search" tab is where you input

your criteria, as shown in the previous example, and

where you get your results. The results are ranked from

0-5 (5 being the greatest), based on the risk vs reward.

You are able to sort the results by the type of position

you are looking to take (i.e., buy or sell), the stock

symbol of the trade, the enter/exit dates of the trade,

and many other important trade characteristics. At the

bottom of each tab you are given a visual chart based

on the trade you have selected, which can be changed

by clicking the three charts found on the right side of

the screen to help give you a better visual

understanding of the past behavior of the trade. These

three charts include an equity curve showing the

historical return characteristics of the trade, a

histogram with year-over-year profit and loss data, and

a pie chart that shows the average risk and average

reward of the trade.

Once you have moved your chosen trades to

the”Neural Network” tab by double clicking, or by

selecting the “Add” box in the first column, you will be

given yet another opportunity to increase the

probability of a successful trade. This tab utilizes the

“Neural Network” feature of TradeMiner Pro, which

calculates the probability of each of the historical stock

trends in your portfolio occurring in the current year.

After you have analyzed your trades through the

TradeMiner Pro’s Neural Network, each of the trades

selected will be rated from Very High-to Very Low in

probability. I absolutely love this feature, because it

saves me hours of my time, and help me find the

perfect trades that fit my trading strategy.

In the “Portfolio” tab there is another feature that

helps traders further organize their portfolio. This

Filter Portfolio query is designed to help investors limit

the number of trades overlapping. The “Portfolio” tab

also allows you to keep future trades that you are

interested in on hand, by saving them in your “Pick

List”. This allows you to maintain a focused stock

portfolio to meet the demands of the closest trades,

while not losing out on valuable stock trade data that

you have compiled. I absolutely love both the Neural

Network and the Filter Portfolio features, because it

saves hours of my time, and help me find the perfect

trades that fit my trading strategy.

The next tab, “Trade Alerts” of

TradeMiner Pro is a new addition

to the software that adds

convenience, and simplicity to my

trading. This feature gives you

the opportunity to schedule email

alerts that will remind you of your

upcoming trades. Simply check

the “Alert” box, found in the

column to the left of the “Begin

(Open)” date of the “Neural

Network”, or “Portfolio” tabs to

transfer your trade to the “Trade

Alerts” tab. This tab gives the

option of scheduling your alerts

to notify you of your upcoming

trading opportunity 1-10 days in

advance for each of your stocks,

making you sure you never miss

the your perfect trade.

Step four of your TradeMining process consists of

accounting. TradeMiner makes it easy for you to keep

track of your stock portfolio results as a whole by

listing all of the trades that you have taken, and

calculating total profits/losses for each year/month.

This data, as with all other data, can be displayed in a

variety of visual charts on the right side of the screen.

This tab was very useful in helping me track my own

trading trends, and helped me map out next year’s

future trading strategy.

There are also two more important tabs that I should

quickly mention. If you click on the "Settings" tab you

can select the universe of stocks that you want the

TradeMiner Pro to search through. Your selection could

simply be all active stocks in each index, or only one of

the individual indexes. It is all up to you.

The final tab in TradeMiner Pro is the “Education” tab.

When you click on this tab your browser will open and

you will have access to education material from the

TradeMiner Pro website. Since education is one of the

most important aspects of successful investing, this is

definitely a very valuable

feature of the software, and it

is included in each of the

TradeMiner Pro packages.

TradeMiner Pro for stocks,

specifically, has multiple

educational videos to help you

get started, TradeMiner Pro

manual, frequently asked

question, Current Market

Analysis posted weekly for

Trading Club members, and

access to a free 14-day of the

Track ‘N Trade Trading

Platform trial. What a deal!

In summary, TradeMiner Pro is

a excellent tool for any trader

who is looking to gain an

investing edge through

analyzing historical stock

trends and cycles. Even

though the TradeMiner Pro

software is based on complex

mathematical formulas that

allow the software to quickly

mine, sort, and organize large

amounts of historical data, the

simple interface makes using the software user

friendly, so that anyone can quickly learn how to use

the software effectively to find the trades that they’ve

been looking for.

By giving each user the ability identify the market

trends and cycles that tend to repeat themselves over

time, the TradeMiner Pro software is definitely a must-

have for any trader, from beginning traders to

seasoned professionals, who is looking for a statistical

edge in the markets.

by: Kent Kofoed Mr. Kofoed is a market technician and

research analyst for Gecko Software, Inc.

Call: 1-800-862-7193 Ext. 2

Discover Historical Trends

And Market Cycles

Ph: 1-800-862-7193 Ext. 2

*For your convenience data and alerts will automatically renew yearly at the end of the current term - cancel anytime. Trading financial instruments, including Stocks,

Futures, Forex or Options on margin, carries a high level of risk and is not suitable for all investors. The high degree of leverage can work against you as well as for you.

Before deciding to invest in any of these financial instruments you should carefully consider your investment objectives, level of experience, and risk appetite. Only risk

capital should be used for trading and only those with sufficient risk capital should consider trading. The possibility exists that you could sustain losses exceeding your

initial investment. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts. Past

performance, whether actual or hypothetical, is not necessarily indicative of future results. All depictions of trades whether by video or image are for illustrative purposes

only and not a recommendation to buy or sell any particular financial instrument. Due to trade commissions variability they have not been factored into any trade

examples. The impact on market prices due to seasonal or market cycles may already be reflected in market prices.

See full risk disclosure.

Figure A-1: A close-up screenshot of the allowable criteria that can be specified in TradeMiner.